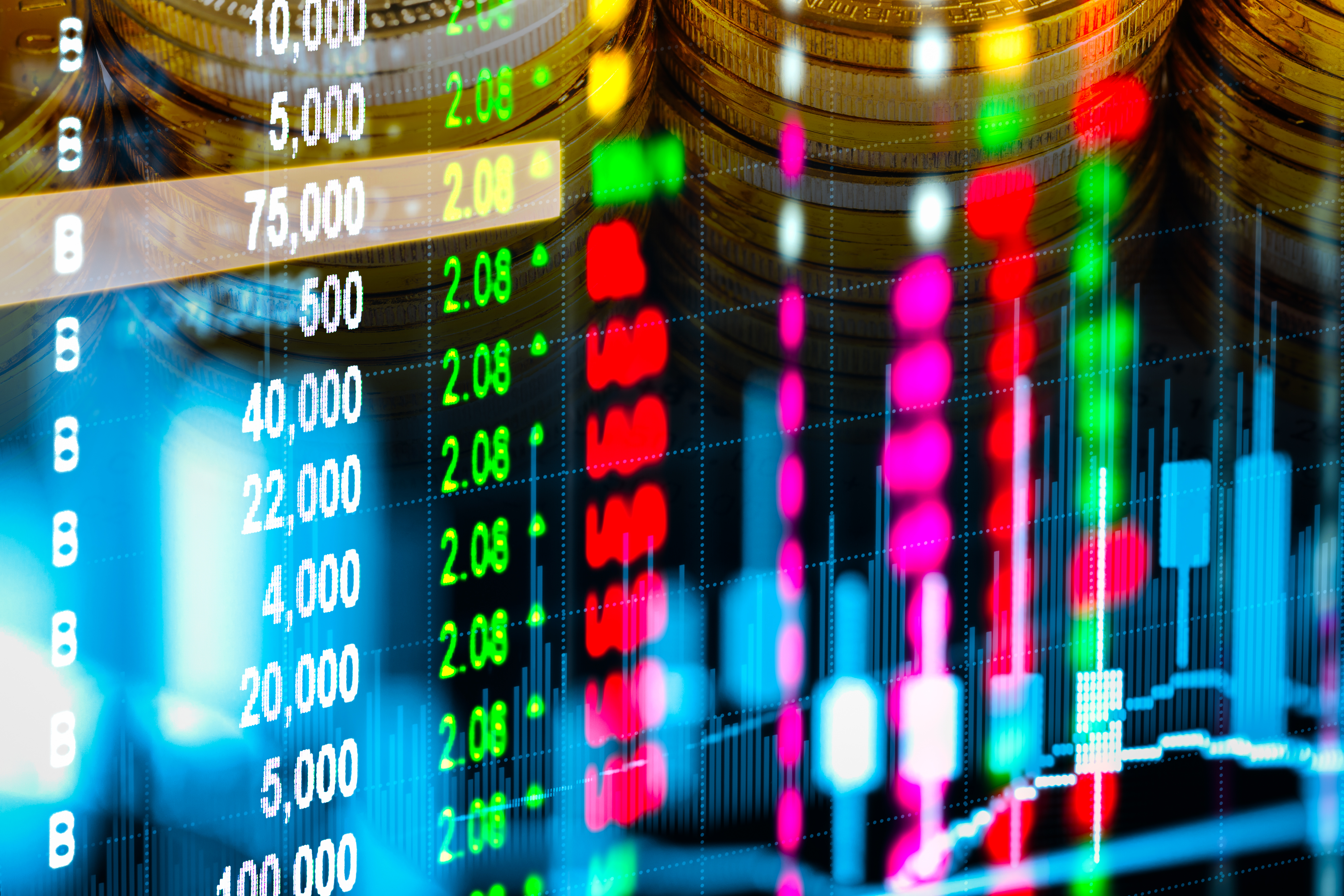

Dow Climbs Nearly 150 Points on Strong Gains from UnitedHealth and McDonald’s

The Dow Jones Industrial Average closed nearly 150 points higher on Wednesday, supported by strong advances in shares of UnitedHealth Group and McDonald’s, two of the index’s heaviest weighted components.

UnitedHealth shares rose 2.2%, while McDonald’s gained 1.6%, together contributing roughly 73 points to the Dow’s total advance, according to market data. The index’s performance underscored the influence of price-weighted constituents in driving intraday momentum.

Additional support came from gains in Merck & Co., Nike, and American Express, which helped broaden the rally and reinforce positive sentiment across multiple sectors.

Healthcare and Consumer Leaders Drive the Market

UnitedHealth’s rise followed renewed optimism in the healthcare sector, with analysts citing stable earnings expectations and resilient demand metrics. McDonald’s, which has been navigating a challenging consumer environment, advanced as investors reacted positively to updated guidance and ongoing international expansion efforts.

The combined performance of these industry leaders helped offset pockets of weakness elsewhere in the market and pushed the Dow further into positive territory during the afternoon session.

Market Sentiment Improves

The Dow’s gains contributed to a broader improvement in risk appetite across Wall Street, with investors reassessing opportunities in large-cap stocks ahead of upcoming economic data releases.

Analysts note that the index’s reaction reflects continued investor confidence in defensive and consumer-oriented names, especially those with strong cash-flow profiles and consistent dividend histories.

Outlook

Market participants will now turn their attention to labor data, inflation readings, and upcoming corporate guidance that may determine whether the Dow can sustain upward momentum. If leadership from healthcare and consumer giants persists, the index could see additional support in the coming sessions.

-

NEWSROOM

We are a dynamic daily channel dedicated to delivering essential insights on economics, business, and politics—empowering professionals and decision-makers to navigate a complex and fast-evolving world. Our content blends in-depth reporting, exclusive analysis, and strategic interviews to help readers stay informed, anticipate opportunities, and make smarter decisions. Connect with us at info@moneyinfocus.news

to collaborate or learn more.