- media@moneyinfocus.news

Markets Edge Higher as Nvidia Jumps and Investors Eye Inflation Data

New York, NY – July 16, 2025 – U.S. stock futures rose on Tuesday, reflecting investor optimism ahead of key economic data and corporate earnings reports. S&P 500 futures gained 0.4%, while Nasdaq 100 futures advanced 0.6%. Dow Jones Industrial Average futures remained relatively unchanged.

Tech giant Nvidia led premarket gains with a surge of over 4%, following news that it will resume sales of its best-selling H20 AI chip to China. The company received clearance from U.S. authorities, easing concerns about export restrictions to the region.

The move comes after the semiconductor giant secured assurances from Washington that these exports will be approved under current U.S. regulations.

In a company blog post, Nvidia confirmed it "expects to begin deliveries shortly," marking a significant milestone amid ongoing tensions around U.S.-China tech exports.

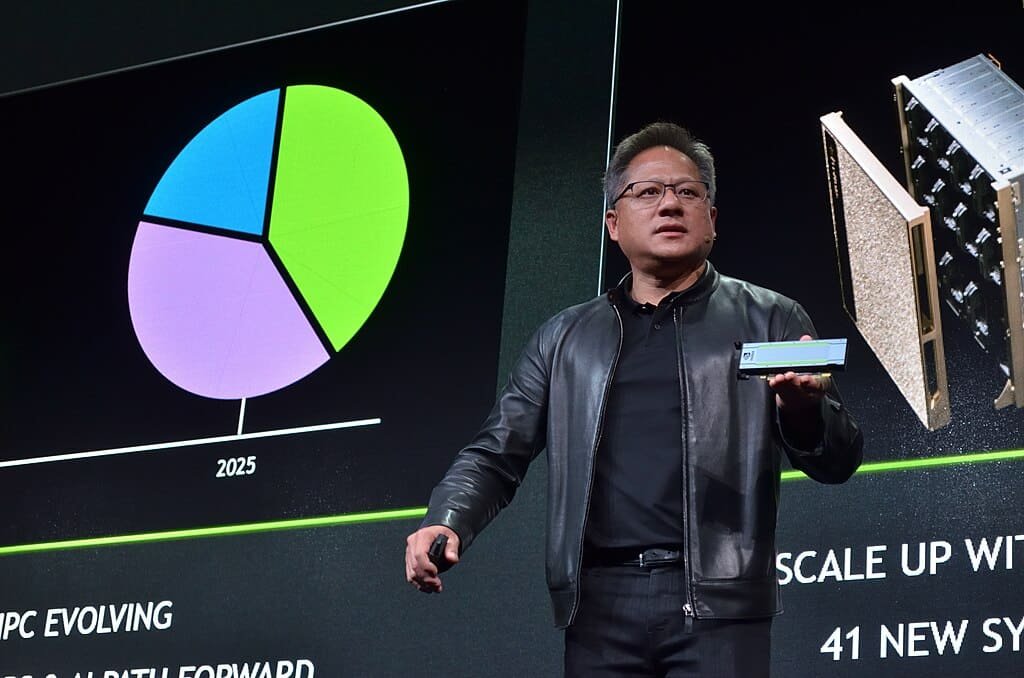

The decision is a strategic win for CEO Jensen Huang, who has become increasingly vocal in his criticism of restrictive U.S. chip policies. Huang previously described the Biden-era AI diffusion rules as a "failure" and urged for their reversal. Though the Trump administration has signaled plans to roll back some of these regulations, no formal changes have been made.

Nvidia, now valued at over $4 trillion, has seen billions in lost revenue due to semiconductor restrictions targeting China — a key market for its advanced computing products. The H20 chip is one of Nvidia’s top-performing AI processors, and its return to the Chinese market may help recapture lost momentum and reinforce the company’s global dominance in AI technologies.

Market analysts view this development as a turning point, not only for Nvidia but also for the broader semiconductor industry. It underscores a shift in U.S. enforcement priorities and renews hope for more stable tech trade relations between Washington and Beijing.

Investors Eye Inflation Data

The positive sentiment extended to JPMorgan Chase, whose shares climbed 0.5% after posting earnings and revenue that exceeded analysts’ expectations. Citigroup also saw an uptick of 0.9% in premarket trading, ahead of releasing its financial results later today.

However, not all sectors followed the upward trend. Wells Fargo shares dropped 1.2% after the bank lowered its full-year net interest income forecast, dampening investor enthusiasm.

Investor attention is now turning toward the Consumer Price Index (CPI) report, due later this week, which could shape expectations for future Federal Reserve policy moves. With inflation trends and corporate earnings both in focus, markets remain cautiously optimistic.

We are a dynamic daily channel dedicated to delivering essential insights on economics, business, and politics—empowering professionals and decision-makers to navigate a complex and fast-evolving world. Our content blends in-depth reporting, exclusive analysis, and strategic interviews to help readers stay informed, anticipate opportunities, and make smarter decisions. Connect with us at info@moneyinfocus.news

to collaborate or learn more.