- media@moneyinfocus.news

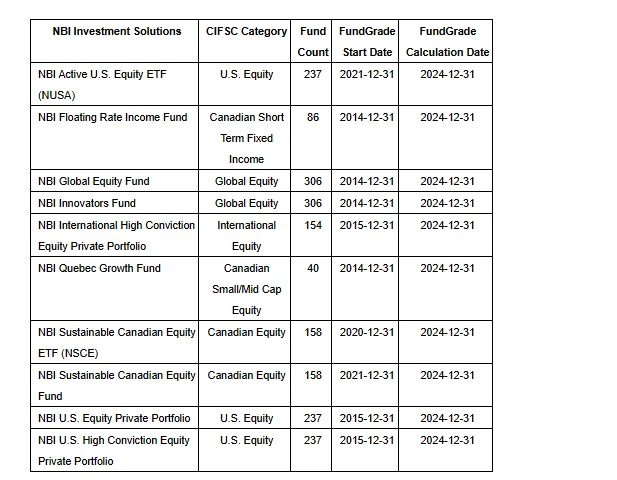

National Bank Investments Inc. (“NBI”) won ten awards at the Fundata 2024 FundGrade A+ Awards ceremony held on February 6, 2025. These awards recognize Canadian investment funds that have maintained an exceptional performance rating over the entire previous calendar year.

®

“We are proud to receive these FundGrade awards as a testament of our ongoing commitment to providing Canadians with premium high-performance investment solutions. This recognition is the result of our open architecture strategy which allows NBI to collaborate with some of the world’s top portfolio managers to create value for investors over the long term,” said Martin Felton, Vice-President, National Sales at NBI.

NBI was recognized for the superior performance of the following investment solutions in their respective categories:

FundGrade A+® is used with permission from Fundata Canada Inc., all rights reserved. The annual FundGrade A+® Awards are presented by Fundata Canada Inc. to recognize the “best of the best” among Canadian investment funds. The FundGrade A+® calculation is supplemental to the monthly FundGrade ratings and is calculated at the end of each calendar year. The FundGrade rating system evaluates funds based on their risk-adjusted performance, measured by Sharpe Ratio, Sortino Ratio, and Information Ratio. The score for each ratio is calculated individually, covering all time periods from 2 to 10 years. The scores are then weighted equally in calculating a monthly FundGrade. The top 10% of funds earn an A Grade; the next 20% of funds earn a B Grade; the next 40% of funds earn a C Grade; the next 20% of funds receive a D Grade; and the lowest 10% of funds receive an E Grade. To be eligible, a fund must have received a FundGrade rating every month in the previous year. The FundGrade A+® uses a GPA-style calculation, where each monthly FundGrade from “A” to “E” receives a score from 4 to 0, respectively. A fund’s average score for the year determines its GPA. Any fund with a GPA of 3.5 or greater is awarded a FundGrade A+® Award. For more information, see www.FundGradeAwards.com. Although Fundata makes every effort to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Fundata.

We are a dynamic daily channel dedicated to delivering essential insights on economics, business, and politics—empowering professionals and decision-makers to navigate a complex and fast-evolving world. Our content blends in-depth reporting, exclusive analysis, and strategic interviews to help readers stay informed, anticipate opportunities, and make smarter decisions. Connect with us at info@moneyinfocus.news

to collaborate or learn more.