- media@moneyinfocus.news

Colombia’s digital payments industry is booming, with the country’s leading mobile transactions platform Nequi at the forefront. EBANX, a global technology company specializing in payment services for rising markets, has reported a significant increase in Nequi’s cross-border transaction volume. Merchants of EBANX offering the payment method in Colombia have seen an average month-over-month growth of 33% in Nequi’s transaction volume since September of last year.

This increase highlights Nequi’s growing popularity in Colombia’s digital market, which is the third-largest in the Latin America region, behind only Brazil and Mexico. “Merchants looking to grow sales in Latin America must stay attuned to the technological evolution of payment methods in each country,” said Eduardo de Abreu, Vice President of Product at EBANX. Since 2020, when EBANX announced the integration with Nequi, the Colombian platform’s user base has jumped from 4.8 million to 21 million, half the adult population of the country.

EBANX is closely monitoring the changes this innovation has brought to the lives of Colombians, particularly for unbanked customers and businesses. “Imagine a small business owner in Bogotá, who has always relied on cash transactions to run his store, making it difficult to manage finances and track sales. With Nequi, he can accept digital payments, send funds to suppliers instantly, and purchase office supplies and digital tools online, even from abroad,” exemplified de Abreu.

Businesses and entrepreneurs now account for 15% of Nequi’s user base, according to the platform’s data. The VP at EBANX highlights that the growing presence of Nequi users reflects the significant transformation of digital commerce in Colombia in recent years. According to Payments and Commerce Market Intelligence (PCMI) data analyzed by EBANX, Colombia’s e-commerce has expanded ninefold since Nequi’s launch eight years ago and is expected to grow by 18% annually through 2027.

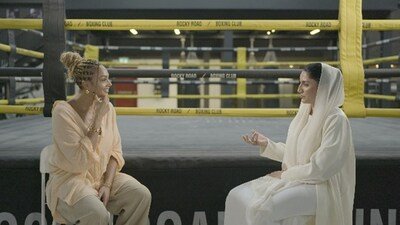

“The digital revolution has transformed the way money flows globally, making international transactions more accessible, faster, and safer,” said Andrés Vásquez, CEO of Nequi. “This transformation has fueled the growth of cross-border transactions – those where the payer and recipient are in different countries. At the same time, the global market is expanding, that is why at Nequi, we are committed to adapt to these new global dynamics by facilitating the efficient and cost-effective reception of international payments, leveraging our existing expertise,” Vásquez added.

In the new edition of Beyond Borders, EBANX’s annual comprehensive study on the digital market and payments in emerging economies, Nequi is highlighted as part of a growing wave of innovative solutions expanding access to credit in rising markets. According to Statista’s data in Beyond Borders, 48% of mobile payment users in Colombia do not own a credit card. Meanwhile, account-based transfers, like Nequi, are projected to grow at an annual rate of 24% in the country through 2027, per PCMI.

Nequi in the real-world payments

Created by the financial institution Bancolombia, Nequi provides users with access to payments, transfers, bank accounts, and credit products. According to the platform’s internal data, three out of five adults in Colombia use Nequi to manage their finances from their smartphones. The elevated rates of mobile usage for day-to-day life are reflected in the online world: The country has the highest share of digital commerce purchases made through mobile devices across all of Latin America, at 87%, according to PCMI.

Eduardo de Abreu added that the system has expanded to enable real-world payments. “Although Nequi was initially designed to serve the digital commerce needs of users, the service has expanded its capabilities to support brick-and-mortar stores by introducing features like QR code payments for in-person transactions and the Nequi card for offline purchases,” he explained. The VP of Product also attributes Nequi’s success to the platform’s instantaneous refund process: “This streamlined approach ensures a hassle-free

We are a dynamic daily channel dedicated to delivering essential insights on economics, business, and politics—empowering professionals and decision-makers to navigate a complex and fast-evolving world. Our content blends in-depth reporting, exclusive analysis, and strategic interviews to help readers stay informed, anticipate opportunities, and make smarter decisions. Connect with us at info@moneyinfocus.news

to collaborate or learn more.