- media@moneyinfocus.news

The global economy enters 2026 facing a new reality: volatility is no longer episodic—it has become structural. After years of monetary tightening, geopolitical fragmentation, and technological acceleration, global capital markets are being reshaped by forces that extend well beyond traditional economic cycles.

According to the International Monetary Fund, global growth in 2026 is expected to remain uneven, with emerging and frontier markets increasingly outperforming mature economies in relative terms. Meanwhile, advanced economies continue to grapple with elevated debt levels, demographic pressures, and the long-term effects of higher interest rates.

What differentiates this moment is not slowdown, but reallocation.

Smart capital in 2026 is prioritizing resilience over acceleration. Investors are rotating away from purely growth-driven strategies toward assets and regions capable of delivering predictable cash flows, regulatory stability, and geopolitical insulation.

The World Bank has highlighted a renewed concentration of investment in countries offering energy security, strategic commodities, and advanced infrastructure—particularly those positioned within reconfigured global supply chains.

This explains the sustained interest in North America, select European hubs, and parts of the Middle East and Southeast Asia, where capital benefits from legal clarity and long-term policy alignment.

While inflationary pressures have moderated in several regions, interest rates remain structurally higher than in the previous decade. This has permanently altered the cost of capital.

In response, institutional investors and family offices are favoring private credit, structured debt, and asset-backed financing, rather than traditional fixed income alone. According to data referenced by the OECD, private markets now represent a central pillar of global capital allocation strategies.

Liquidity, once taken for granted, has become a strategic variable. Capital in 2026 values flexibility—the ability to reposition quickly across asset classes and jurisdictions.

Geopolitical risk is no longer a background consideration; it is a core input in portfolio construction. Trade realignments, tariff regimes, sanctions, and regional conflicts are actively shaping investment decisions.

Supply chain “friendshoring” and “nearshoring” trends continue to redirect capital toward politically aligned economies, reinforcing a bifurcated global system. Investors are increasingly assigning a geopolitical risk premium to assets, favoring jurisdictions perceived as neutral, stable, or strategically indispensable.

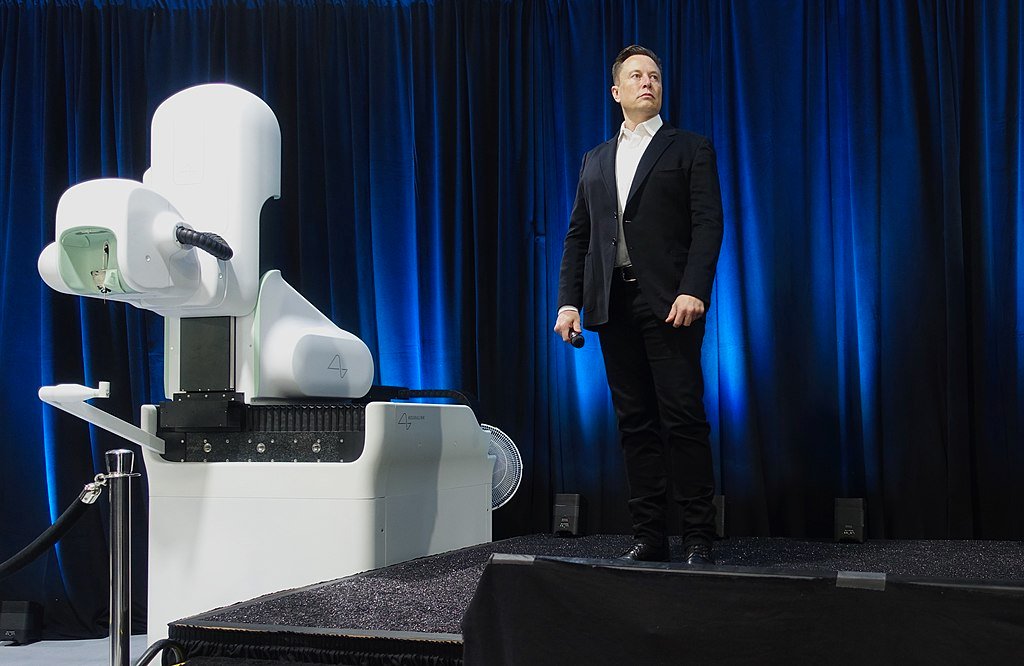

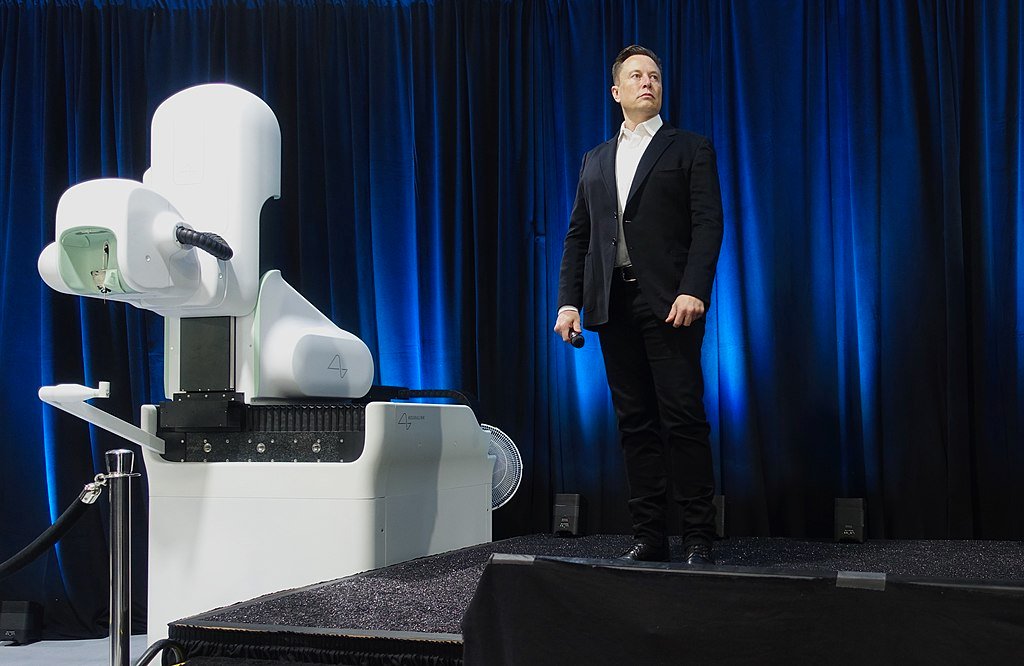

Artificial intelligence, data infrastructure, and energy transition assets remain magnets for long-term capital. However, in 2026, investors are more selective—prioritizing profitability, regulatory compliance, and scalability over speculative growth narratives.

Energy security has re-emerged as a strategic investment theme, particularly in renewables, grid modernization, and transitional fuels. These sectors are now viewed not only as ESG plays, but as geopolitical hedges.

For sophisticated investors, the question in 2026 is no longer where growth is highest, but where capital is safest, most mobile, and best positioned to endure systemic shocks.

Those aligning macroeconomic intelligence, geopolitical awareness, and jurisdictional diversification are building portfolios designed not just to perform—but to survive and compound across cycles.

In a world defined by fragmentation and transformation, smart capital is not chasing certainty. It is engineering resilience.

Sources: IMF, World Bank, OECD, Reuters, Bloomberg

Disclaimer

Money In Focus is an independent journalism platform. Content is provided for informational purposes only and does not constitute investment, legal, or tax advice. Readers should conduct independent research and consult qualified professionals when making financial decisions.

World Economic Outlook (WEO)

https://www.imf.org/en/Publications/WEO

Global Financial Stability Report

https://www.imf.org/en/Publications/GFSR

Global Economic Prospects

https://www.worldbank.org/en/publication/global-economic-prospects

Global Investment Competitiveness Report

https://www.worldbank.org/en/publication/gicr

OECD Economic Outlook

https://www.oecd.org/economic-outlook/

Global Capital Flows and Investment Policy

https://www.oecd.org/investment/

Global Economy & Markets Coverage

https://www.reuters.com/world/

Global Markets and Investment Analysis

https://www.reuters.com/markets/

Global Economy and Markets

https://www.bloomberg.com/markets

Bloomberg Economics – Global Outlook

https://www.bloomberg.com/economics

All sources listed above are internationally recognized institutions and media organizations widely cited by policymakers, central banks, institutional investors, and global financial publications. Data and analysis reflect the most recent information available at the time of publication and are subject to change.

We are a dynamic daily channel dedicated to delivering essential insights on economics, business, and politics—empowering professionals and decision-makers to navigate a complex and fast-evolving world. Our content blends in-depth reporting, exclusive analysis, and strategic interviews to help readers stay informed, anticipate opportunities, and make smarter decisions. Connect with us at info@moneyinfocus.news

to collaborate or learn more.